Netflix's streaming woes are about more than password sharing

If Netflix wanted to "solve" password sharing and add advertisements, it shouldn't have waited until things were at their worst.

Netflix lost subscribers in Q1 2022 for the first time in over a decade, while predicting it would lose 2 million more by June thanks to its crackdown on password sharing. And Wall Street ran screaming. According to CNBC, Netflix's stock plummeted 35%, losing the brand $50 billion in value.

What's truly to blame for the Netflix exodus though? Everyone has an opinion: Ballooning subscription costs, weak programming, the bursting pandemic bubble that kept people at home and glued to screens for two years, or the "woke mind virus," as one supposed genius suggested.

The idiotic hot take from Twitter's would-be owner aside, most of these theories have at least some merit. But experts like technology analyst Carmi Levy have seen the writing on the wall for years, and say that "Netflix leadership should have seen this coming" too.

"During the company’s salad days of uninterrupted double-digit subscriber growth, it ignored creeping structural problems like credential reuse, dissatisfaction with release schedules, licensing limitations in certain countries, among others," says Levy.

"It allowed itself to be lulled into a false sense of security as consistent growth masked the underlying challenges facing the company. It mistakenly failed to address these issues proactively, and instead must now scramble to respond to this inevitable change in fortune."

The Netflix formula is broken

Before tech journalism, I worked in book publishing, where most books either made steady income or barely earned back their author advances. But publishers don't care much about these books, because they're desperately searching for the "next Harry Potter" that'll bankroll their business for years. So when books don't explode in sales — even if they earn glowing reviews — publishers write new authors off after three books and invest in the next potential golden goose.

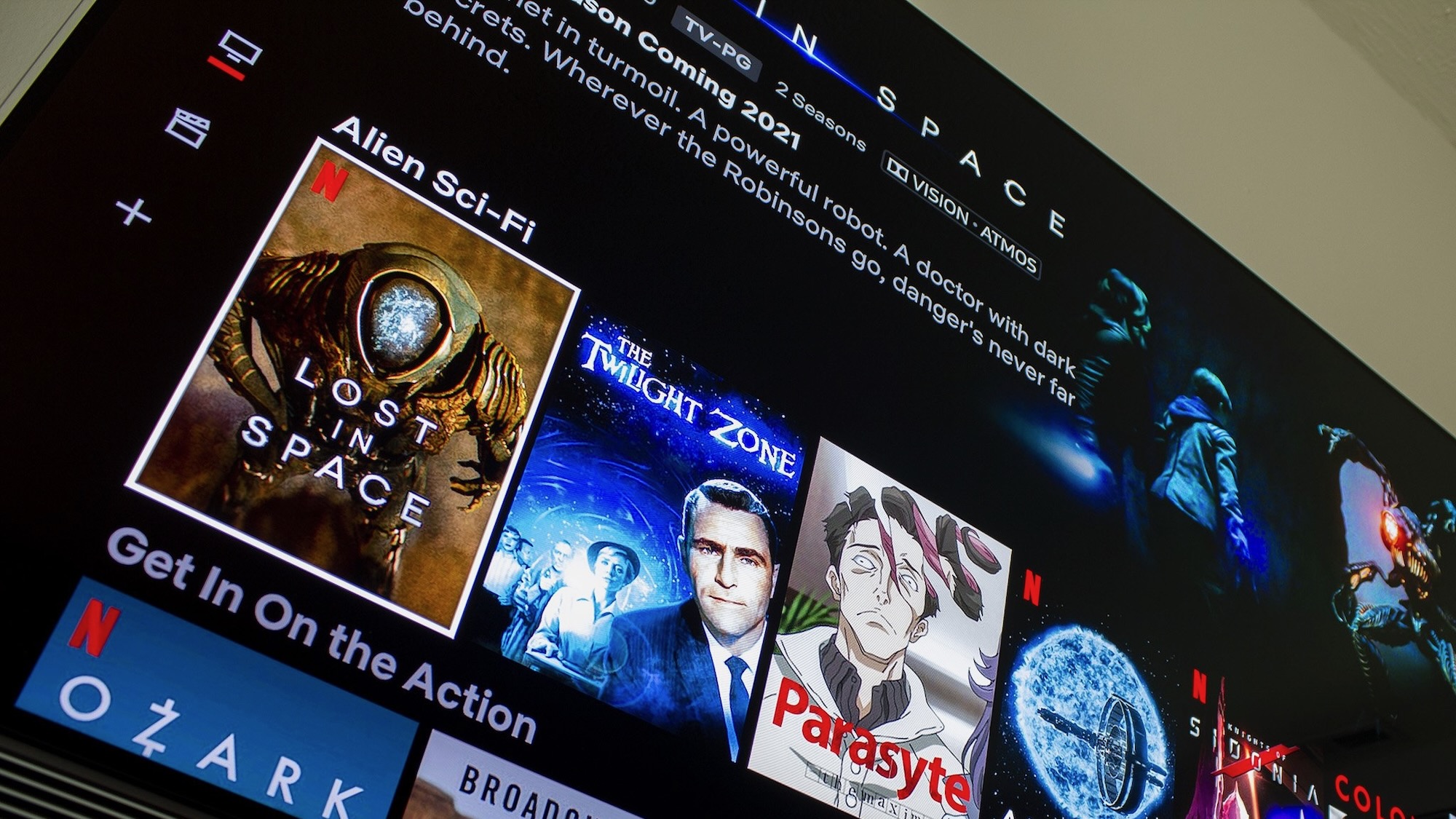

I bring this up because Netflix follows the exact same pattern with its streaming library. It throws new Netflix Originals at the wall every week, desperately hoping they'll become the next Squid Game or Stranger Things.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

If a show doesn't immediately get eyes on screens, Netflix will publicly cancel it within a week — when most other streaming platforms would be dripping out a second episode, trying to grow awareness through word of mouth.

If a show is successful, it'll get a second or third season, but at that point, even popularity won't save it, because that's the point when production costs and actor salaries inflate, and Netflix would rather just launch a new would-be hit for less and chase new subscribers.

Why get invested in any Netflix show if you know it'll last two seasons at most?

"By failing to allow successful content to breathe and grow and dig deeper roots among viewers, Netflix is increasingly vulnerable to churn as subscribers try — and fail — to connect with trusted content over the long term," Levy says.

Put plainly, why get invested in any Netflix show if you know it'll last 10-30 episodes, 90% of the time?

When Netflix transitioned from DVD lending to streaming, people came for House of Cards and Orange Is the New Black, but they stayed to binge The Office and Friends while cable TV made you wait weekly. It helped Netflix grow into its massive 220 million subscriber base.

But that formula doesn't work now. People have a bevy of other streaming options from networks, most of which are hoarding and deploying their own syndicated content, while keeping things fresh with weekly appointment television. That left Netflix reliant on its flash-in-the-pan shows.

And when people talk about the best Netflix shows, the first question is either "What episode are you on?" or "Did you finish?" because the app throws every episode at you all at once. No one tweets about it out of fear of invoking spoiler wrath, and then people move on. Not exactly an organic way to build a fanbase.

Anecdotally, I sure don't have the time or bandwidth to sit down and binge a season of television every week or two. An hour or two per show a week is perfect. And if I did, I wouldn't remember the same amount of details when it came time for water-cooler buzz. "That was good ya"April 21, 2022

"An all-in-one release garners headlines and engagement as viewers rush to binge-watch the latest and greatest," Levy pointed out. But "relying too heavily on these types of releases makes it more difficult for subscribers to create regular engagement schedules that would tie them more closely to the platform over time."

It's made more of an impression with Netflix original movies because people can reasonably watch and discuss them quickly. But they also don't capture people's attention for nearly as long as even a mediocre show.

"Netflix will need to experiment with a more diverse mix of release strategies to ensure it appeals to a wider swath of consumers...[and] remain at the top of their preferred-streamer list," Levy says.

Password sharing built Netflix up, and is tearing it down

I'm curious how many people actually pay for more than a couple of streaming services at once. In my personal bubble, different family members and friends pay for and share Netflix, Paramount+, the Hulu / Disney+ bundle, Apple TV+, and HBO Max. And I'd bet most families or friend circles have their own arrangements.

If you add up the total cost for everything, you're basically paying for a cable package, which is what streaming was meant to replace. It's why, in my mind, the video streaming industry is built on password sharing.

It lets people pay what they can afford without missing out on the show of the moment. It lets Netflix subsidize its higher fees because the subscribers rely on others to pay for the other, cheaper services. And it ensures people won't cancel even if they're bored with Netflix, because other people use the same account.

Netflix knew about people's password sharing; it even tweeted in 2017 that "Love is sharing a password." Password sharing costs Netflix $6 billion a year and the global streaming industry $25 billion a year, according to Fortune; but "leadership inertia" amidst years of record-breaking profits meant the execs could keep ignoring the problem to keep users happy.

Now that growth has plateaued, the execs or their shareholders want to claim that lost revenue. But waiting until now to "solve" the problem, instead of offsetting losses during major growth periods years ago, was short-sighted.

More importantly, in my mind at least, if companies start restricting or geolocking accounts, the streaming system could collapse like a house of cards, because no one wants to pay for every streaming app themselves. Netflix won't mind this if it's the one service people keep while abandoning the rest — but that isn't certain these days.

Netflix is currently testing out-of-household fees in countries like Chile and Peru for up to two extra users, for a few bucks each. This would limit excessive sharing and make one subscription quite expensive for the primary user, making it less likely they'll offer to share with friends in future.

Assuming it makes this system global, it could be a less painful solution than banning sharing entirely. But Netflix has already jumped in price several times; paying even more for friends — or Netflix forbidding people from watching it on vacation out of sharing paranoia — will only cause a further exodus and loss of goodwill.

Netflix could try to claim kicked-off users as new subscribers. But that'll depend on whether people used to ad-free freeloading are willing to pay for a cheaper ad-backed subscription instead.

Can Netflix right the ship?

Netflix's current plan is to add a lower-price, ad-supported tier, so people forced out of shared accounts have a cheaper option to retain access, and new subscribers see a lower cost of entry. Will it work?

Levy thinks Netflix can "no longer afford to regularly increase its rates," and that a cheap ad-supported tier could "reduce the company’s exclusive reliance on subscriber revenues, which could reduce the pressure to raise subscriber rates across the board."

In theory, it's a win for everyone. In practice, the streaming giant will have to sell the idea very carefully, as it's liable to be unpopular with long-time users, and "Netflix can’t afford to miss on this one" given its current stock issues.

Netflix is also investing heavily in gaming, making mobile games available for free to subscribers and acquiring exclusives like a League of Legends spinoff. But game development takes years to bear fruit, and by the time a hypothetical tie-in game is finished, Netflix might already have canceled it!

Other mobile gaming platforms like Play Pass and Apple Arcade are much cheaper standalone offerings with hundreds of games, something Netflix can't match on its own. I'm sure its subscribers don't mind getting access to games, but it's going to take a ton of investment and time that the company might not have — while other companies offer it more effortlessly.

That's really the problem for Netflix in a lot of ways. It made a huge splash as the first major streaming service, but it can't match the decades-long backlog of competing services like Peacock, Disney+, and Paramount+; or the ability to bundle its subscription with other products like Apple TV+ and Prime Video.

Whatever streaming device you own, you'll find plenty of other content to watch.

So Netflix can only continue to release original content in a frenzy. Except most people can't possibly watch everything Netflix releases, so they build up a huge backlog. Then Netflix abandons the shows we don't immediately watch, making us not want to watch anything except old favorites we know have satisfying endings. So we cancel our Netflix subscriptions. It's a predictable cycle, but I'm not sure how Netflix will break it.

"It would be naive to believe the company will ever return to the halcyon days when it owned the streaming market and could rely on consistent growth to mask any underlying faults within its business model," says Levy.

But he pointed to Netflix's DVD-to-streaming pivot, suggesting that "changing directions mid-stream is literally baked into this company’s DNA, and it would be premature to assume it can’t pivot once more as the traditional streaming market matures."

Michael is Android Central's resident expert on wearables and fitness. Before joining Android Central, he freelanced for years at Techradar, Wareable, Windows Central, and Digital Trends. Channeling his love of running, he established himself as an expert on fitness watches, testing and reviewing models from Garmin, Fitbit, Samsung, Apple, COROS, Polar, Amazfit, Suunto, and more.