Here's how POCO plans to conquer the budget 5G segment with the POCO M3 Pro 5G

POCO took the smartphone world by storm in 2018 when it introduced the POCO F1. The phone's flagship-tier hardware, along with never-before-seen affordability, turned it into an instant success in India and other Asian markets, and what started out as a fledgling experiment turned into a viable brand that has a presence in over a dozen global markets.

POCO was able to leverage the success of the F1 to break into the budget segment. The POCO X2 series brought 120Hz screens to sub-$200 phones, and POCO continued that momentum with the POCO X3 NFC and X3 Pro, with the former netting over 4 million sales in seven months. The brand then made its foray into the entry-level category with the C series and diversified its budget offerings with the M series. The POCO M3 in particular stood out because of its oversized camera module and bright yellow paint job.

To date, POCO has sold over 17 million phones around the world, and the budget M series is a huge sales driver. The M3 alone racked up over 3 million sales following its introduction in November 2020, and POCO is now looking to build on that success with the introduction of the POCO M3 Pro 5G, the first 5G-enabled phone in the M series. The M3 Pro is important not only because it brings 5G connectivity to this segment but also because it is the first POCO phone sold globally to be powered by a MediaTek chipset.

Ahead of the POCO M3 Pro launch, I talked to Kevin Xiaobo Qiu, who heads POCO global, and Angus Ng, POCO global's head of product marketing. We chatted about the upcoming POCO M3 Pro and the recently-released POCO F3, the brand's journey so far, and how it plans to differentiate itself in the budget segment. Qiu joined POCO in 2018 and was instrumental in setting up the brand in Spain, and the executive now oversees its global business. POCO was borne out of Xiaomi, and while it branched out as a standalone entity last year, it continues to rely on Xiaomi for the manufacture and distribution of its phones.

"We still share resources from Xiaomi, including R&D, manufacturing, and after-sales service. Xiaomi's infrastructure and scale gives us a lot of benefits around manufacturing and distribution, but as a brand, we function independently," said Qiu.

POCO relies on Xiaomi for manufacturing, but the brand is creating its own unique aesthetic.

POCO also shares designs with sister brand Redmi — the POCO F3 that recently made its debut is a global version of the Redmi K40, which is limited to China at the moment. Qiu mentions that there will be "some crossover" between the two brands but that POCO is working on creating its own design language and standout software features. We've already seen that with the M3, and the M3 Pro will also have a unique design — and yes, you'll be able to pick it up in yellow.

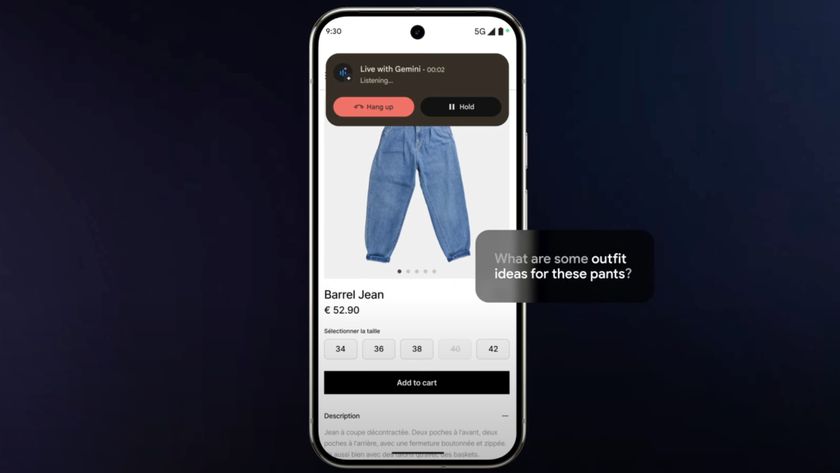

What's particularly interesting about the M3 Pro is that it is powered by a MediaTek Dimensity chipset. POCO has launched phones featuring MediaTek's Helio chipsets, but these devices were limited to India. "Based on our performance evaluation and the price where this device will be positioned, we felt that this hit the spot," said Ng. "We believe that this chipset can live up to our fans' expectations."

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

Qiu says that the MediaTek chip used in the POCO M3 Pro is a sizeable upgrade from the Snapdragon 662 that's powering the regular M3, noting that there's a significant uptick in performance. "We have two upgrades with this chipset: a boost in performance and 5G connectivity." In POCO's internal testing, the M3 Pro scored 329,072 on AnTuTu, versus 301,635 for the standard M3.

The M3 Pro 5G is significantly faster than the regular M3 — and it's getting a high refresh rate display.

The M3 Pro isn't positioned as a gaming device — POCO is leaving that to the X and F series — but Ng says that the phone will handle daily usage and intensive games at medium settings just fine. The key differentiator for the device is 5G connectivity. "We want to give people an easier way to switch to 5G. By giving them an option at a lower price point, they can experience 5G when they want to," said Ng. "We wanted to make it more accessible for our fans to connect to 5G."

The M3 Pro also has a high refresh rate, another first in the M series. It will include more RAM out of the box, and a faster storage module than the regular M3 and will be available in three color options. The upgrades on offer make the M3 Pro a very enticing choice in the budget segment, and with the phone set to slot in at around a similar price point as the X3 NFC, POCO is planning on retiring the product and position the M3 Pro instead as the go-to budget choice. For those that need increased performance, there's the X3 Pro.

Xiaomi branched out into the high-end segment last year with the Mi 10 series, and more recently, the Mi 11 Ultra takes that formula and kicks it up a notch — creating one of the best Android phones of 2021. While POCO has launched value flagships in the form of the F2 Pro and the F3, Angus Ng said that introducing a "super flagship" is not on the cards at the moment.

"We've definitely discussed launching a super flagship. The F3 features a Snapdragon 870, and it is better than last year's Snapdragon 865. One of the major issues we've noticed when we try to go up against phones like the Xiaomi Mi 11, Galaxy S21, and iPhone 12 is that it's difficult to get the price down," said Ng. "We're at a point where there's negligible difference between the various flagship chipsets. The MediaTek Dimensity 1100, 1200, Snapdragon 865, and 870 are roughly on the same level, and we have great confidence in the Snapdragon 870 and felt that the performance is up to what we wanted it to be."

"What super flagships do well is innovate; they introduce new features that don't exist yet. We're at a point where we're choosing from existing innovations — we won't make something that will be the first — but we will choose the most suitable features for our consumers," said Ng.

Qiu mentions that it is important to strike a balance when coming up with new products. "We're always looking at balance when considering the latest technologies and how they influence pricing. We could have increased the price by $200 and offered the latest flagship processor, but our philosophy is about striking the right balance."

POCO caters to a younger audience, so I asked Qiu and Ng if we'll see a gaming-focused phone from the manufacturer. "We've explored the possibility of launching a phone with pop-up buttons, but we believe that gaming phones are still a luxury," said Ng. "When we created the F3 and X3 Pro, we had elements of a gaming phone in terms of performance, but we didn't want to go overboard on the design front." Don't hold out for wearables or audio products by POCO anytime soon either — the brand is looking into the AIOT segment, but the focus is currently on phones.

POCO instead sees software as a major differentiator, and although its interface is based on MIUI — and will continue to do so for the foreseeable future — it offers unique customizability. POCO's take on Xiaomi's interface is called MIUI for POCO, and it includes an app drawer, icon customization, and other tweaks. MIUI lacked an app drawer of its own, so Xiaomi integrated POCO's implementation within MIUI 12, so if you've used a Mi or Redmi phone this year, the app drawer is from POCO.

Get ready to see a lot of "exclusive" software features in POCO UI — coming later in 2021.

Ng says bringing differentiated software features is one of the goals for 2021. "We are going to add some special features to make MIUI for POCO into a more exclusive look for our customers. It will still be based on MIUI's codebase, but we're looking at exclusive features for the upgraded interface. We are still collecting a lot of feedback from our community and social media on what they would like to change." The new interface could be dubbed POCO UI, with a launch slated for sometime by the end of 2021.

Ng noted that POCO could create its own interface from scratch if it gains more market share globally, but at the moment, it is not feasible. I asked Ng whether POCO would launch a phone running Android One — Xiaomi released three devices in collaboration with Google — but that isn't a direction that POCO is considering at the moment. Sorry, Android One fans.

Ng acknowledged that software is not POCO's "number one strength" from a product point of view but mentioned that the company is looking to improve upon it and that it is "one of the biggest areas of focus" internally. Although there isn't a definite timeline for the new features, Ng said that they would be debuting before the end of the year — the goal for POCO right now is to solicit feedback from its existing users.

The user community is an area where POCO is making strides. Xiaomi and its associated brands have always relied on user engagement and engagement for everything from new software features to product strategy, and that's a key area of focus for POCO as it makes headway in global markets.

"We launched the POCO Community app on the Play Store back in March for our users to engage with the brand, and within two months we got over 13,000 registered users in the forums," said Qiu. "We actively listen to feedback from our POCO fans and incorporate the suggestions into our product lines." So if you want a POCO phone with a 120Hz AMOLED screen, it's time to start engaging with the brand.

POCO has established its presence in countries like India and Indonesia over the last 18 months, and it is increasingly focused on European markets. The POCO F1 made its way to Spain shortly after its launch in India and was available in the UK shortly thereafter, and POCO sees Europe as a key region for its global ambitions. Qiu said that the biggest challenge in setting up the brand in Spain was the fact that e-commerce sales were minuscule when seen against retail, but POCO found a way to get users to pick up its phones: aggressive pricing.

POCO is making headway in global markets, but don't hold out for its phones in North America.

"If you can launch a product with very good performance and also sell it at a good price, you can disrupt it. Even if the e-commerce market share is low in the beginning, if you have a really good product, users will find a way to buy it," said Qiu. "When we launched the F1 in Spain, e-commerce sales contributed to 10% of overall phone sales. It now stands at over 20%. As we focus exclusively on e-commerce, we've set up our own official store globally, and users in over 10 global markets — including Spain, France, Italy, Germany, and Indonesia — can buy products directly from the store."

While POCO is making headway in a few western markets, don't hold out for its phones to be available in the U.S. "POCO is available in more than 35 markets, and with every new market we enter, we evaluate the local conditions," said Qiu. "Our focus right now is to grow in the markets we are in right now."

"For a country like the U.S., the usual consumer behavior when buying a phone is via contracts. It's rare for users to buy phones outright — regardless of whether it costs $500 or $1,000 — they usually go with a contract," said Ng. "We haven't leveraged the carrier operations model, and while it is something we could explore in the future, it is not a priority at the moment."

Xiaomi sells a lot of accessories in North America, but it is yet to launch its phones in the country, and that's unlikely to change with POCO. So while you won't see POCO phones in the U.S. or Canada, the brand is making strides in India, Indonesia, and other Southeast Asian markets, and it is starting to gain momentum in Spain, France, and the UK. For now, POCO's focus is on consolidating its position in these markets, and the long-term strategy is to foray into new countries and categories. What will remain unchanged is the focus on value.

Harish Jonnalagadda is Android Central's Senior Editor of Asia. In his current role, he oversees the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.