Smartphone growth continues to surge in Q2 2024 results thanks to AI

Analysts say optimism in the smartphone market has to do with artificial intelligence.

What you need to know

- The International Data Corporation (IDC) and Canalys both released preliminary results for the worldwide smartphone shipments in the second quarter of 2024, reporting overall growth.

- IDC reported a 6.5% growth by the top five companies, while Canalys reported a 12% growth overall compared to last year's results.

- Samsung is the leader in shipments so far in 2024, and that success is partially attributed to its AI push.

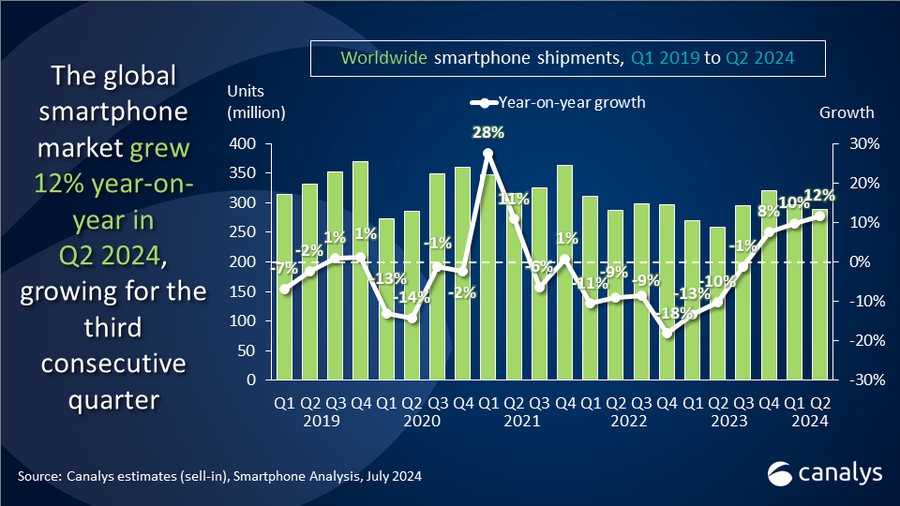

After a down period, smartphone shipments seem to be steadily on the rise worldwide, according to preliminary results from the second quarter of 2024. The year has seen the smartphone market rebound globally, as firms International Data Corporation (IDC) and Canalys documented. The overall smartphone market grew by 12% year-over-year, hitting 288 million units, Canalys reports.

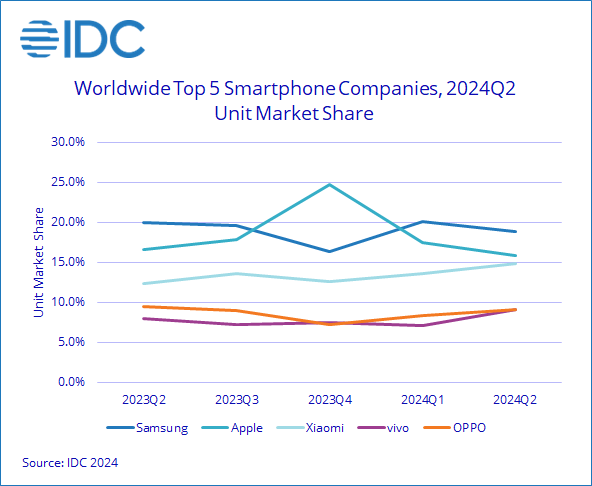

The top five companies in terms of global shipments grew 6.5% on their own, according to IDC. Samsung led the pack with a 19.8% market share in Q2 2024, closely followed by Apple at 15.8%. Xiaomi, Vivo, and Oppo rounded out the leaderboard in that order. However, the difference between Vivo and Oppo's market share was roughly 0.1%, meaning that the two companies were statistically tied for fourth place.

Though Apple and Samsung were the market leaders once again, the companies didn't see significant growth last quarter. Samsung grew just 0.7% year-over-year, while Apple grew 1.5% year-over-year. The biggest climber was Xiaomi, which shipped 27.4% more phones in Q2 2024 compared to Q2 2023.

Samsung and Apple have been vigorously competing for the top spot, and there's a bit of separation between those two companies and Xiaomi in third. Another large gap separates Xiaomi from Vivo and Oppo, which round out the top five in global shipments.

Canalys' report shows that there was significant growth by companies outside the top five. For what it's worth, Canalys lists Transsion as the fifthmost leader in smartphone shipments. These smaller and growing brands are giving leaders like Samsung a run for its money in emerging markets.

"Since early 2024, easing inflation in emerging markets across Asia-Pacific, the Middle East, Africa, and Latin America has stimulated shipment growth in the mass-market price segment," said Canalys analyst Sheng Win Chow. "Companies, including Xiaomi and Transsion, are actively promoting product upgrades to capitalize on these opportunities. Meanwhile, Honor, Oppo, and Vivo are focusing their expansion outside Mainland China this year as competition in the domestic market is heating up.”

Regardless, it's clear that Samsung has had immense success this year so far, on the heels of Galaxy AI software features and new flagship devices. The company moved a total of 54.9 million units last quarter alone.

Get the latest news from Android Central, your trusted companion in the world of Android

What's driving Samsung's success this year?

We've talked at length about how Samsung could, and should, be doing more to innovate in the smartphone market. This year's Galaxy S24 Ultra was an impressive phone with a tiny asterisk since it had aging cameras that are starting to fall behind Apple and Google's competing sensors. The same story became true just recently when the company announced its new foldables, the Galaxy Z Flip 6 and Galaxy Z Fold 6.

Both of those phones are relatively minor upgrades, save for the Z Flip 6's new main camera sensor and the Z Fold 6's wider cover screen. Samsung neglected to improve the Galaxy Z Fold 6's rear camera system for the second year in a row, which is why I said I wouldn't buy it.

So, how is Samsung the global phone shipments leader despite these common criticisms about its strategy? Well, it's important to remember that we won't see the impact of the Galaxy Z Flip 6 and Galaxy Z Fold 6 in the above results. These figures are from Q2 2024, meaning they are largely including sales from the Galaxy S24 lineup and Samsung's A-series budget devices. Those low-end devices are key, because Samsung sells quite a bit of budget and midrange phones in emerging markets around the world.

However, according to the analysts, it's artificial intelligence that may be driving the company's success. Samsung started shipping a full Galaxy AI suite of software features this year, and some of these features run on-device.

"There is lots of excitement in the smartphone market today thanks to higher average selling prices (ASPs) and the buzz created by Gen AI smartphones," said Nabila Popal, who is a senior research director for IDC, "which are expected to grow faster than any mobile innovation we have seen to date and forecast to capture 19% of the market with 234 million shipments this year."

Google is also selling Pixels with AI features, and Apple will follow up with Apple Intelligence later this year. However, Samsung has had the advantage of being first with a lot of key features and services. For example, Google's flagship Circle to Search feature debuted on Galaxy devices first before later coming to its own Pixel lineup.

While many are waiting for the AI bubble to burst, the experts say the hype drives smartphone shipment growth in 2024. The reception and sales figures related to the Galaxy Z Flip 6, Galaxy Z Fold 6, and Motorola Razr 2024 foldables might give us an idea of whether this kind of growth is sustainable.

Brady is a tech journalist for Android Central, with a focus on news, phones, tablets, audio, wearables, and software. He has spent the last three years reporting and commenting on all things related to consumer technology for various publications. Brady graduated from St. John's University with a bachelor's degree in journalism. His work has been published in XDA, Android Police, Tech Advisor, iMore, Screen Rant, and Android Headlines. When he isn't experimenting with the latest tech, you can find Brady running or watching Big East basketball.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.