MediaTek is coming for Qualcomm as US market share gap narrows

MediaTek's market share in the U.S. is inching closer to Qualcomm's.

What you need to know

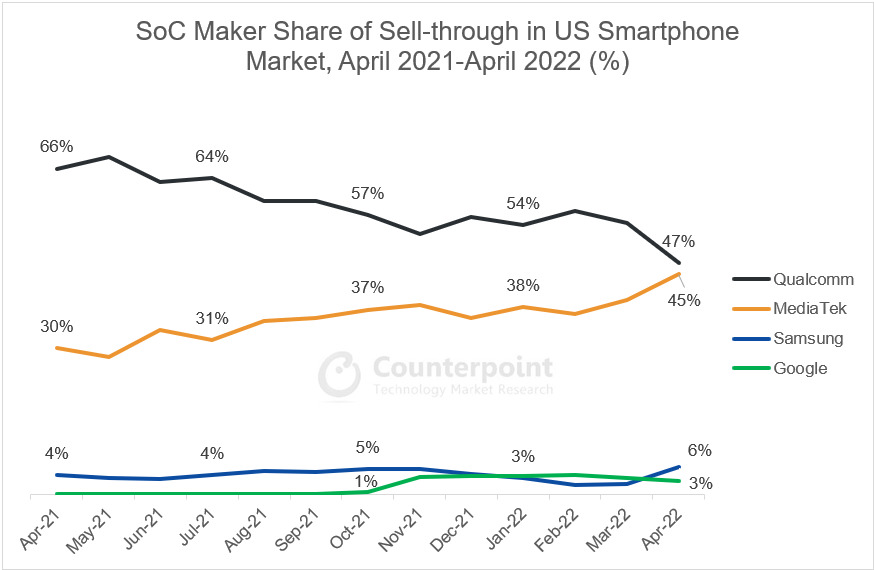

- MediaTek's U.S. market share has hit a record high at 45% in April 2022.

- Qualcomm's share in the U.S. is 47%, signaling a shift in demand and in Qualcomm's leadership.

- Google and Samsung both hold very small percentages of the U.S. SoC market.

MediaTek is on the rise, and it seems like even Qualcomm might be unable to stop it. The Taiwanese chipmaker recently recorded a 45% market share in the U.S. as of April 2022, its highest ever in the country.

A Counterpoint Research report highlights MediaTek's rise at the expense of its biggest rival, Qualcomm. According to the report, Qualcomm holds 47% of the U.S. market, just 2% above MediaTek.

The latest numbers spotlight a trend that's been ongoing since mid-2021 as the market share gap between the two chipset giants becomes smaller and smaller. The chart below reveals Qualcomm's waning rein in the U.S. as MediaTek increases its foothold in the U.S.

Samsung and Google are understandably fighting for the remaining sliver of U.S. market share. Google only has one chipset, which can be found in its latest Pixel 6 smartphones. Meanwhile, Samsung generally reserves its Exynos chips for other markets, instead utilizing MediaTek chips in its lower-end smartphones.

"MediaTek's growth really took off last year with design wins for the Samsung Galaxy A12 and Galaxy A32 5G, which became huge hits in the prepaid market, selling over 5.2 and 3.8 million devices respectively in 2021," notes Matthew Orf, research analyst at Counterpoint Research. "The chipmaker's growth has continued with key design wins again within Samsung for the Galaxy A03s and Galaxy A13 5G, as well as in Motorola with the Moto G Pure and Moto G Power 2022."

Senior research analyst Hanish Bhatia adds that U.S. carriers were instrumental in pushing budget Android phones, many of which take advantage of the lower-cost MediaTek chips.

However, Qualcomm still dominates in the premium segment, as noted by senior research analyst Maurice Klaehne. "Qualcomm recorded a 93% share in the $800 and above segment of the Android market in April, and a 64% share in the $250-$800 Android segment," he says, pointing out strong demand for the Galaxy S22 series.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

However, MediaTek isn't resting on its laurels, and while its focus remains largely on budget and mid-range smartphones, it also has its sights on the premium segment. This is noted by power chips such as the Dimensity 9000 and the recently announced Dimensity 1050, the company's first mmWave 5G SoC.

Our Harish Jonnalagadda warned last year that MediaTek's mid-range resurgence should worry Qualcomm, as the Taiwanese chipmaker offers comparable performance at lower, more attractive prices. And with rumors of upcoming Galaxy flagships sporting MediaTek chips, it looks like Qualcomm's slow decline is set to continue.

The Galaxy A32 5G was one of the best mid-range phones of 2021 and continues to impress today. It sports a 5G MediaTek chipset, a large battery, and a good 48MP primary camera coupled with an ultrawide sensor.

Derrek is the managing editor of Android Central, helping to guide the site's editorial content and direction to reach and resonate with readers, old and new, who are just as passionate about tech as we are. He's been obsessed with mobile technology since he was 12, when he discovered the Nokia N90, and his love of flip phones and new form factors continues to this day. As a fitness enthusiast, he has always been curious about the intersection of tech and fitness. When he's not working, he's probably working out.