Meta's $10 billion VR losses are reasonable but came at the worst time

The revelation that Meta's Reality Labs lost a net $10 billion despite record-breaking Quest profits over the holidays raised plenty of eyebrows. But with the dust settled, analysts argue that Meta fully needs to burn through billions to keep up its lead in the VR/AR space. The problem is that Meta intended to bankroll these costs with ad profits that have dried up, which could lead to a breaking point for the company.

Meta's 2021 earnings call couldn't have gone much worse. After Apple, Google, and Microsoft all reported record-setting profits last week, Meta brought much more dour news. Facebook user numbers declined for the first time in its history, ad revenue dropped, and stocks plummeted as a result.

Meta had reasonable explanations for its failings. Global "supply chain shortages" reduced small businesses' advertising budgets, cutting off Meta's bread-and-butter. Apple's new customer privacy tools ensured the "accuracy of our ads has decreased" while measuring ad click outcomes "became more difficult." And to compete with Tiktok, Meta has pushed Instagram Reels, which "monetizes at a lower rate" than longer videos.

Meta claims its Reels strategy will prove a success "over the long term" but admitted during the call that the issues with Apple and businesses' ad cutbacks aren't going away anytime soon. So the question becomes whether Meta can continue to subsidize VR as exorbitantly in future years without as much ad money to bankroll it.

Gotta have money to spend money to make money

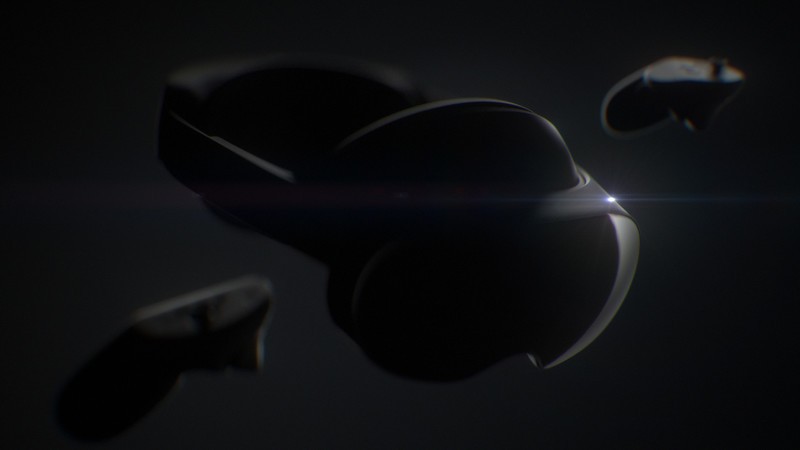

Meta explained during the earnings call where most of that $10 billion is going: R&D on upcoming VR hardware — Project Cambria, Project Nazare, and other unannounced headsets like the Quest 3 — increased marketing and legal costs, "core infrastructure investments," and "over 3,700 net new hires in Q4."

Running a Super Bowl ad, actively poaching VR engineers from rivals, and fighting the FTC over antitrust allegations adds up to an expensive operating budget.

Meta's running more ads than ever, and frankly needs to do so now that the Meta Quest name change has officially arrived. Major acquisitions like the $400 million purchase of a popular VR exercise app certainly cuts into its budget. And Meta has actively poached VR/AR engineers from a variety of competitors, to the point that Apple (which lost 100 employees to Meta already) started giving $180K bonuses to its AR/VR engineers so they'll stay.

Why the epic spending spree? Because the Apple VR headset will arrive in a couple of years, and Meta wants to fortify its top VR position before that happens.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

"Meta is front-loading its investment in XR because it wants to have a leadership position in spatial computing when Apple comes to market," says Anshel Sag, senior analyst of Mobility & VR at Moor Insights & Strategy. "Ultimately, being a leader in the spatial computing space isn't cheap."

He pointed out how other VR/AR leaders have encountered major delays trying to enter the field. Apple's VR headset now won't arrive until 2023, which Bloomberg sources attributed to hardware issues like "overheating, cameras and software." And Microsoft has canceled the Hololens 3, with low morale and a lack of direction hurting the company's chances at a breakout success.

In that context, the Quest 2 only looks like even more of a success. It has helped generate $1 billion in Quest Store revenue on the backs of exclusive Quest 2 games and has made VR relatively affordable while most competitors sell $1,000+ headsets with PC requirements. And these Meta investments could help grow the headset even further into the mainstream.

But can the company sustain this strategy? Meta's shift to Reels is meant to bolster long-term growth with younger audiences, but at a time when the company needs short-term profits more. New hires' salaries will only inflate in subsequent years, while future VR acquisitions will only get more expensive. And Apple's iOS privacy pivot has crippled Meta's future profits that would have helped fund these investments.

"When Meta was still Facebook its game plan expected that social media revenues and profits would help to bankroll the expected losses in VR until VR became large enough to be self-sustaining," Sag argued. When I asked if Facebook might scale back its VR investments out of necessity if ad revenue remains low, he said that "it's entirely possible." The Metaverse won't happen if shareholders push Reality Labs to scale back its ambition.

"These are highly expensive exercises that can only really be justified for a few years without real scale or growth," Sag believes. "The clock is ticking on profitability now that revenue and costs are in the billions."

Spending billions is the norm (for now)

The only difference between Meta and its rivals is that Meta openly described its R&D costs in its earnings report. Apple, Sony, Microsoft, and other mixed-reality rivals sell a variety of hardware, so even if they announce their R&D budget, it won't show an itemized list of how much their VR innovation budget was for the year.

But even if you look at "smaller" XR developers with open funding, you'll see major money thrown around. Sag pointed out how Magic Leap has spent $3 billion thus far, with another $500 million coming for the next iteration.

"Investors understand how expensive these efforts can be and that for a smaller [device] to be competitive, they will still have to spend billions to compete."

Every major VR/AR company will likely lose billions rolling out their devices. The question is whether they can capitalize on the investment.

What this essentially means is that, for now, VR and AR hardware development is the purview of companies that have the capital to spend billions over the course of years without the hope for an immediate return on investment. And among the few companies that fit that description, you'll find ones like Google that seemingly lack the killer instinct to enact their VR/AR vision.

Sag pointed out that there are several open mixed-reality platforms like OpenXR, Snapdragon Spaces, and ThinkReality that let developers create hardware and leave the heavy software lifting to larger companies. The more VR and AR mature, the lower the barrier to entry for smaller companies.

But looking at the SteamVR survey for January 2022, you'll see 46% of PC VR gamers use the Quest 2 and 67% use some form of Oculus hardware. When every VR headset uses similar standards, the one with the most exclusives and brand recognition wins. So long as Meta keeps dominating the wireless VR space with exclusives, it'll also win the PC VR space without any effort. That makes it daunting for any company, big or small, to bet against its popularity.

Where Meta goes from here

Zuckerberg has openly said that the company plans to sell its VR headsets "at cost" whenever possible to make the barrier to VR accessible to as many people as possible. That's why the Quest 2 has sold so well, but it does mean that high hardware sales can't boost profits very efficiently. And if Meta wants to maintain its success, Sag argues, it "doesn't have a choice" except to keep selling its hardware at affordable rates.

"Meta has backed itself into this price corner and will have to make money on the content sales to recuperate whatever charges its taking on the design and manufacture of the headset."

Meta "doesn't have a choice" except to sell its headsets for cheap, even if that reduces profits.

We know that Meta plans to release Project Cambria sometime later this year, which combined with continued Quest 2 and Quest Store sales should boost the company's XR revenue. Unfortunately, Sag isn't convinced Cambria will solve the company's revenue problems.

"I think Meta can and should introduce a more premium tier of product, but that may actually be premature if the company cannot turn a profit first."

A relatively cheap Quest 2 leaves gamers enough money to spend lavishly on the Oculus Store, where Meta gets a hefty cut. But with Project Cambria, consumers' money will all go towards the manufacturing cost, and they'll have less money left over for buying games. Just because it will offer a spec upgrade doesn't mean it'll automatically rake in the cash.

To do that, it needs to offer services and business applications, Sag says, not just content. We know that Meta has a Quest for Business program planned for 2023, which could certainly help on that front. But otherwise, it seems to Sag (and myself) that Cambria's advances are about evolving VR and AR technology for the sake of evolution, rather than offering something consumer- or business-ready that'll generate game-changing profits.

So until the Quest 3 arrives in late 2023 (according to rumors, at least), Meta will have to hope that continued record-breaking Quest Store profits and internal VR/AR advancements keep the company on track, without investors getting too spooked or Apple closing the gap.

Michael is Android Central's resident expert on wearables and fitness. Before joining Android Central, he freelanced for years at Techradar, Wareable, Windows Central, and Digital Trends. Channeling his love of running, he established himself as an expert on fitness watches, testing and reviewing models from Garmin, Fitbit, Samsung, Apple, COROS, Polar, Amazfit, Suunto, and more.