MediaTek's mid-range resurgence should worry Qualcomm

This time last year, Qualcomm dominated the mid-range category. The company's decision to launch the Snapdragon 765G alongside the Snapdragon 865 meant that value flagships were able to leverage features limited to the best Android phones, with standout devices like the Pixel 5 and OnePlus Nord utilizing the chipset.

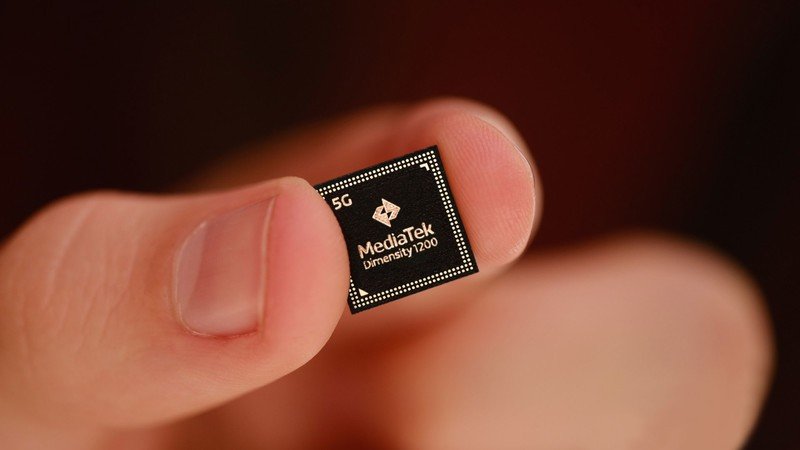

Things are a bit different in 2021. I just finished testing the latest mid-range phones — including the Reno 6 Pro, OnePlus Nord 2, and POCO F3 GT — and what was surprising was that all of these devices featured MediaTek's Dimensity 1200 chipset. This would have been unheard of even two years ago; most brands shunned MediaTek's designs because they weren't on par with what Qualcomm had to offer, and what few wins it managed came in the budget segment with devices like the Redmi Note 8 Pro series.

To its credit, MediaTek was able to turn things around with its 5G-enabled offerings in the Dimensity series. In particular, the Dimensity 1200 is a stellar chipset that holds its own against the Snapdragon 780G, delivering robust performance and global 5G connectivity. While I don't have the numbers to back it up, it is entirely likely that MediaTek is undercutting Qualcomm in terms of pricing, making it that much more enticing to device makers.

MediaTek's chipsets power the best mid-range phones of 2021.

The result is that over the last 18 months, MediaTek has not only managed to regain its footing but also launch chipsets that went up against the best that Qualcomm has to offer in the mid-range segment.

Sravan Kundojjala, Associate Director at Strategy Analytics' Handset Component Technologies, notes that MediaTek successfully capitalized on the increasing demand for 5G, with the company seeing a 143% year-on-year increase in its mobile business in Q2 2021. Kundojjala says that 5G was a key driver in MediaTek's recent surge, allowing the brand to "improve its average selling prices and profits dramatically." With the brand amassing a market share of 26%, it is now the second-largest mobile chipset maker:

MediaTek's margins more than doubled in Q2 2021, driven by improved costs structure and product competitiveness. We estimate that MediaTek ranked number two in the smartphone applications processor market with a 26 percent revenue share in Q2 2021.

We've seen increasing diversification in the semiconductor industry as vendors seek new revenue streams — Qualcomm is investing in automotive, IoT, audio, and wearables — and MediaTek is no different. The company's chipsets power the best Chromebooks, Wi-Fi 6 routers, and more. "MediaTek has a strong footprint in Chromebooks, tablets, digital streaming devices, DTVs, Wi-Fi 6 and power management ICs. As a result, MediaTek is on track to see over 45 percent growth in 2021, reaching approximately $16 billion," says Kundojjala.

While MediaTek has made heady gains in the mid-range segment, it continues to struggle in North America. Kundojjala notes that there are a few MediaTek-powered phones in the U.S., like the Galaxy A32 5G. But because its biggest customers — Xiaomi, OPPO, and Vivo — do not have a presence in the country, it hasn't been able to challenge Qualcomm in any meaningful way.

Get the latest news from Android Central, your trusted companion in the world of Android

That could change in the coming years as MediaTek shifts focus to the flagship segment, an "essential category" for the U.S. market, as Kundojjala puts it. MediaTek's earlier efforts in this category haven't amounted to much; it wasn't able to measure up to what Qualcomm was doing with the Snapdragon 800 series. "MediaTek tried with the Helio X30 (10 nm) chip before but failed to get momentum as the company had a weak modem and performance compared to Samsung and Qualcomm," says Kundojjala.

MediaTek will take the fight to Qualcomm in the flagship segment next year.

"However, MediaTek now integrates the latest Arm cores and has solid multimedia and connectivity IP. MediaTek will re-enter the flagship market early next year with its 4nm (N4)-based Dimensity 5G SoC, which will include 5G Release 16 and integrate Cortex-X2 CPU core." In addition, Kundojjala says that Xiaomi, OPPO, Vivo, Realme, Redmi, and Lenovo will adopt MediaTek's flagship next year, giving the chipmaker much-needed momentum in this category.

So what does this mean for Qualcomm? The chipmaker has posted soaring revenues in Q2 2021 on the back of strong handset, RF front-end, and IoT sales, and that is unlikely to diminish soon. With 5G requiring more components and increasing the manufacturing cost, Qualcomm is ideally positioned to leverage its technology.

For instance, even though Google is switching to its custom Tensor SoC for the upcoming Pixel 6, it is estimated that the search giant will still use Qualcomm's RF front-end and IP licensing, as highlighted by Kundojjala.

But unlike years past, it isn't smooth sailing for Qualcomm. It is seeing stronger competition in the budget and mid-range categories from MediaTek and Samsung, and that rivalry will soon extend to the flagship category. Samsung is set to introduce its first AMD RDNA 2-powered chipset shortly, and MediaTek will challenge Qualcomm with its upcoming 4nm Dimensity chipset in 2022.

Qualcomm has diversified its portfolio well beyond the smartphone segment, and it has managed to leverage its RF and licensing tech to manufacturers that don't use its mobile chipsets. That said, the mobile business continues to deliver nearly half of Qualcomm's overall revenue, and if it wants to stand out in 2022, it needs to do something truly special in this area.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.