Inside the Galaxy: How Samsung is losing its lead in key global markets

Samsung makes many of the best Android phones, and with over 300 million sales a year, it is the largest smartphone maker in the world. While Samsung's lead may have been unassailable a few years ago, that's not the case in 2021. Missteps with the Galaxy S series and slowing demand for flagships in general have eroded profits from Samsung's mobile division in recent quarters, and it is facing an increased challenge from Chinese rivals.

Although Samsung is in a dominant position in North America, that's not true in other markets. Chinese brands in recent years — including Xiaomi and BBK Electronics — owned OPPO and Vivo — have managed to dethrone Samsung in key regions, including China, India, and even Europe. As a result, Samsung's position as the world's largest smartphone manufacturer is under threat.

The latest data from Counterpoint Research bears this out: Samsung sold 57.9 million phones in Q2 2021, with a global market share of 18%. Xiaomi came in second with 52.5 million sales and a 16% market share, but when it comes to annual growth, Samsung is at a meager 8%, while Xiaomi stands at 82%.

So let's take a detailed look at how Samsung is faring in key global markets and if it can manage to hold on to its position as the leading phone maker in the coming quarters.

North America

In North America, the smartphone market share is predominantly split between Samsung and its biggest competitor Apple. Per Q1 2021 market share data from Counterpoint Research, Apple's share of the market was at 55%, while Samsung accounted for 28%.

Overall, Samsung doesn't prioritize one region over another, IDC's research director on worldwide device trackers, Nabila Popal, said in an interview. "As a company, you want to have large centers, and you will always focus on driving share. (Samsung) measures their own performance based on volume share versus value share," she said. "For them, any region is important where they can drive quality."

Among Android device makers, Samsung is virtually unchallenged in North America.

Popal noted that while there is quarterly seasonality, Samsung has still remained strongly at number two, and overall, North America represents a large volume globally. "Between the U.S. and Canada, it's about 11% of global markets. It's relevant, and to be a global player, you cannot ignore a market like the U.S.," she said. Compared to other regions, North America operates a bit differently, and Samsung's strategy specifically is that the volume of smartphone sales is structured and goes through telecom operators, Popal explained.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

While unlocked phones are on the rise, an overwhelming majority of phones sales are through carriers, and Samsung was able to strike key carrier partnerships a decade ago. Even now, Samsung is one of the best choices for Android users looking for a 5G-enabled phone that works seamlessly across the three major U.S. carriers.

Neil Shah, vice-president of research at Counterpoint Research, said in an interview that in North America, the bulk of Samsung's sales come from the S and Note series "though it is doubling down with 5G A-series to capture the LG mobile market share after its exit." LG's official exit in April 2021 will allow Samsung to "increase its share further in North America, Korea, and Latin America," Shah added.

With LG out of the picture, Samsung doesn't have much in the way of competition in North America — at least in terms of Android phone makers. Lenovo-owned Motorola and HMD Global's Nokia have a foothold in the budget segment, and there's a new entrant in this category: OnePlus. With the Nord N series selling over 1 million units in the last two quarters, OnePlus has posted a sales uptick of 428%, and now that it is fully integrated into OPPO, it is ideally poised to take advantage of LG's exit. But it will be several years before OnePlus can get anywhere near Samsung in North America.

Asia

The Asian smartphone industry is heavily influenced by Chinese manufacturers, and Samsung has seen its market share in this region erode over the last five years. For instance, Samsung's market share in China has been under 1% for some time now, and in India, the brand is in danger of losing out on its second position to Vivo and Realme.

The dominance by brands like Xiaomi, Realme, Vivo, and OPPO is because of their focus on the budget segment. Popal says that 87% of smartphones in APeJC (Asia Pacific excluding Japan and China) retail for under $400, with the sub-$200 accounting for 67%. In the first half of 2021, the market share for Chinese brands in the sub-$400 segment is at 67% in the region, while Samsung stands at 20%.

As is increasingly becoming the case in other regions, Xiaomi is in the overall lead in Asia. "Over the years, Xiaomi's share has grown from 17% in 2018 to 21.5% in 2021H1, closely narrowing the gap to leader Samsung, whose share now is 22.3% in 2021H1 (from 27% in 2018)," said Popal.

To get a better understanding of the figures, we're going to break this section down into key regions — China, India, Southeast Asia, Korea, and Japan — and find out how Samsung is doing in each market.

China

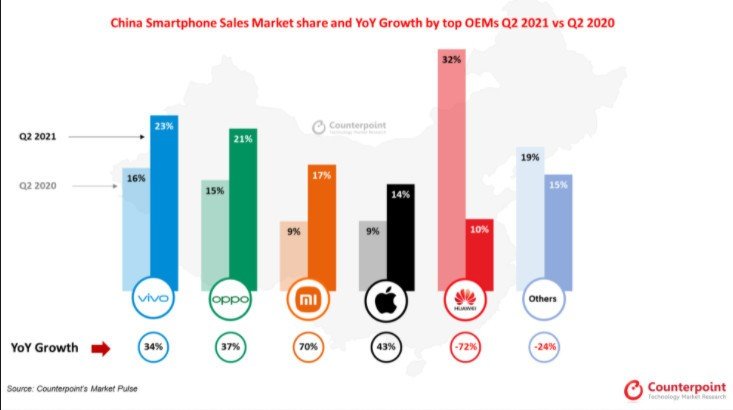

The Chinese market is dominated by BBK's Vivo and OPPO, which accounted for 23% and 21% of the 74.9 million shipments in Q2 2021. Xiaomi came in third with a 17% share and a YoY growth of 70%, with the Mi 11 and Mi 11 Ultra allowing the brand to close the gap to BBK.

Popal pointed out that the top eight brands in China account for 97% of the market, with the Chinese brands' share of that amounting for 83%. With a share of under 1%, Samsung doesn't make it into the list. Samsung was the largest phone brand in China back in 2013 with a market share of 20%, but its dominance in the country has steadily declined following the entry of Huawei, Lenovo, Xiaomi, OPPO, and Vivo.

The domestic players offered better value for money — undercutting Samsung significantly in the budget and even premium segments — and introduced new features like retractable cameras and bezel-less designs, allowing them to seize the momentum. "It has been hard for the global leader to compete in that market due to intense competition from local Chinese players with their strong product portfolio, extremely competitive pricing, more localized services ecosystem and better channel relationships," said Popal.

Another factor that played a role is the Chinese government; Popal states that the local players had the backing of the government, while Samsung did not. Samsung's market share was already down to 3% by 2016, and the Note 7 debacle sealed its fate in China. As a result, Samsung shuttered its last phone manufacturing factory in China a few years ago in favor of new facilities in Vietnam and India as it shifted focus to these markets.

India

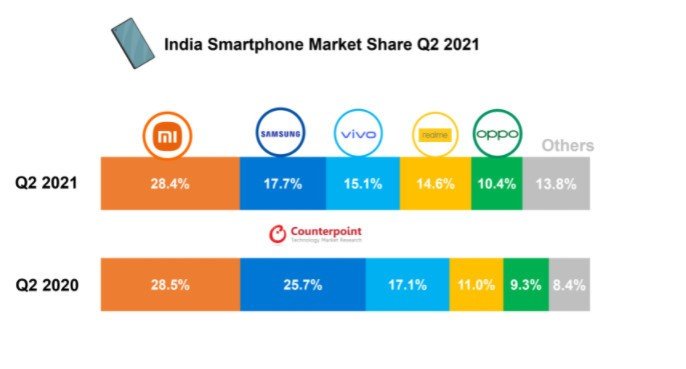

Xiaomi overtook Samsung to become India's largest handset brand in Q4 2017, and it hasn't relinquished that lead to date. India is a key region for Samsung's global ambitions; it is the third-largest smartphone market in the world, and following the downturn in China, Samsung redoubled its efforts in India.

A bulk of the sales momentum in India is focused on the budget segment, and Samsung offers a slate of phones tailored for this category — including several models sold exclusively in the country. The Galaxy M series has been particularly lucrative for the brand. IDC's Associate Research Manager Upasana Joshi points out that Samsung is also one of very few brands that still make feature phones, and this continues to be a differentiator for the brand — particularly against its Chinese rivals.

The South Korean brand's Galaxy J series fared well in India in years past — in spite of offering underwhelming hardware — and Samsung was able to burnish sales in the entry-level and budget categories with the recent strategy shift in the Galaxy A series. It consolidated the Galaxy J, Galaxy C, and Galaxy On offerings into the Galaxy A series, and launched the Galaxy F and M series for an e-commerce push.

Realme and Vivo could knock Samsung from second place in India.

Samsung has a vast distribution and retailer network in India, and it has relied on this model to drive a majority of its sales. But sales from this channel have decreased in recent quarters, so the brand has started being more aggressive with the e-commerce segment to position itself as an alternative to Xiaomi and Realme. And that has paid off; Joshi notes that Samsung is now the second-largest brand in the online segment. Joshi also says that as Samsung is considered a lifestyle brand — owing to the fact that it sells everything from TVs to washing machines and refrigerators — resulting in better "brand awareness, stickiness and loyalty."

While Samsung noticed a decent uptick in sales, it isn't growing as fast as its Chinese rivals. According to IDC, Samsung sold 5.5 million phones in India in Q2 2021, accumulating a market share of 16.3%. Xiaomi, meanwhile, accounted for 9.5 million sales with a market share of 29.2%. While Samsung managed to hold on to second position for the last four years, it may not retain its standing as BBK-owned Vivo and Realme continue to see heady gains. Samsung posted a 15% growth from 2020 while Xiaomi's sales grew by 84%, Vivo by 57%, and Realme by a staggering 174.9%.

Southeast Asia

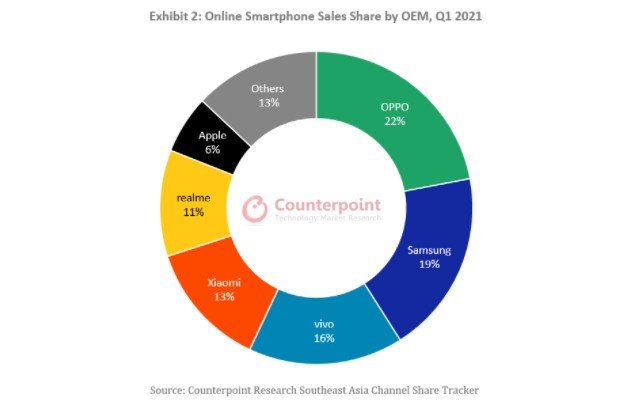

Southeast Asia is another market that is turning into a key battleground for phone makers. Data from Q1 2021 from Indonesia, Thailand, Vietnam, and the Philippines see OPPO in the overall lead with a 22% market share, followed by Samsung with 19% and Vivo at 16%.

OPPO's push into the mid-range with the Reno series and its budget-focused A series allowed the brand to maintain its lead, while Samsung's Galaxy A series was its biggest sales driver in the region. As for individual markets, Thailand saw an 18% YoY increase in sales in Q1 2021, with OPPO holding on to the top spot with a share of 22%. Samsung is in second with a 20% share, followed closely by Vivo at 19%.

Samsung has an overwhelming majority in Vietnam with a 37% market share in Q2 2021, followed by Xiaomi at 17% and OPPO with 16%. However, Samsung's fortunes in Vietnam are heavily reliant on its budget portfolio, with the likes of the Galaxy A02s, A12, and M31 making up a bulk of its sales in the country.

Samsung's strong budget portfolio combined with an extensive retail presence in the region should allow it to hold steady in Southeast Asia. Still, with e-commerce on the rise and the likes of Realme making inroads, it needs to shore up its online strategy.

Korea

Samsung is dominant in its home country, with the brand controlling the smartphone segment with a market share of over 70%. The brand is virtually unchallenged when it comes to Android, with LG a distant third at less than 6%. Apple is in second with a 22% share, and with LG exiting the handset business, Samsung will be able to extend its lead in Korea, says Popal:

Although Samsung already has majority lead commanding over 70% share of the market, with LG's exit, Samsung will definitely benefit in the $400 segment where LG has some share and where Xiaomi is almost negligible.

With Xiaomi starting to get aggressive in the low to mid-range tiers in Korea, Popal says that Samsung will face increased rivalry in the sub-$400 segment in its home country.

Japan

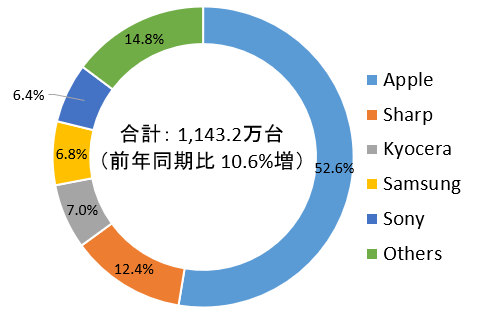

Much like China, Samsung doesn't have a strong presence in Japan. According to IDC's figures for Q4 2020, Apple has an overwhelming majority with a 52.6% share, followed by Sharp at 12.4% and Kyocera at 7%. Samsung is fourth with a 6.8% market share.

Samsung's lackluster sales in the country could be attributable to the tensions between South Korea and Japan. To counter this, Samsung even removed its logo from phones back in 2015 and rebranded devices to the Galaxy label, but that didn't lead to any meaningful uptick in sales figures.

Latin America

Unlike North America, where Samsung faces strong competition from Apple, its market share in the Latin America region is strong and at number one, Popal said. The company stands at 40% market share in the region, followed by Lenovo hovering between 15 and 20%, and Xiaomi in third place with just under 10%.

Popal said that with Huawei exiting the market, Samsung has found a huge opportunity and has strongly benefited from it. "Especially in LatAM, Huawei had a large share, and with them exiting the Chinese brand Xiaomi has increased their focus in that region, but Samsung has benefited," she said.

Huawei's exit occurred shortly after the former U.S. President Donald Trump placed sanctions on software from specific China-based companies that posed a national security threat in the U.S. Losing access to Android, Google Mobile Services, and the Play Store meant Huawei was no longer a viable option. "The U.S. sanctions impacted (Huawei's) access to components and access to Google Mobile Services," she said, adding that no matter how great the device is, it's worthless if Google pulls its services and Android stops working.

Latin America is a market where Samsung doesn't have much competition. Of the Chinese contingent, only Xiaomi and Lenovo (via Motorola) have an established presence in the region, and that's not going to change in the foreseeable future. Furthermore, the lack of local manufacturing in countries like Brazil has inhibited Xiaomi's efforts to scale up effectively. Samsung already accounts for four out of ten phones sold in Latin America, and that momentum isn't likely to abate anytime soon.

Europe

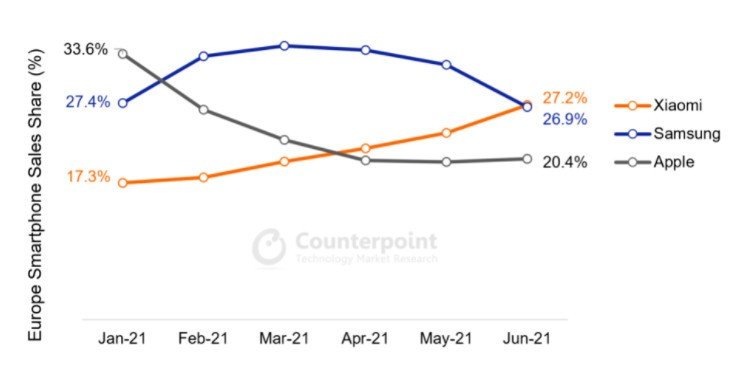

Similar to Latin America, Counterpoint Research's Shah noted that Huawei's exit would be beneficial to Samsung in Europe. However, in Q2 2021, Xiaomi overtook Samsung to become the top smartphone vendor in the region, according to new data from Strategy Analytics.

Smartphone shipments of Xiaomi grew 67.1% year over year to reach 12.7 million units. Samsung, which up until recently held the top spot, shipped 12 million phones in Q2 2021, down 7% compared to the same period a year ago. Apple stays in the third spot with a 19.2% market share.

"Europe is the next big battleground between Samsung and Chinese brands, which are making inroads fast in Eastern Europe and some Western European markets such as Spain, Italy, Portugal, and the Nordics," Shah said. "An aggressive sub-$150 5G A-Series portfolio will help Samsung retain its market share in coming quarters."

Popal noted similarly that Samsung will face more competition in the low-end with the rising growth of Chinese smartphone vendors. She noted that competition with China-based companies intensified in 2017, around the time that Samsung's A series was launched in the region, though the launch of those phones was very successful for Samsung.

"(Samsung) was facing a strong threat in the mid-to-low end due to the massive rise of the Chinese brands in the years prior. With Samsung's launch of the A series, phones with high specs and low prices, it was an excellent move. (Samsung) really strengthened their position in the low-to-mid end, and secured their position as market leaders in the volume gain," she said.

While Samsung is positioning affordable Galaxy A devices with 5G — like the A52 5G — to maintain its momentum in the region, recent launches like the OnePlus Nord 2 and Reno 6 Pro offer more exciting designs and better cameras.

Middle East and Africa

With a year-on-year growth of 35%, MEA (Middle East and Africa) is a fast-growing market. The latest numbers from Counterpoint Research put Samsung in the lead with a market share of 16%, but as is the case elsewhere, that lead is down from 20% a year ago.

Xiaomi is in third with a share of 11%, but it's the Transsion-owned brands that are making huge gains in this region. We haven't really talked about Transsion Holdings a lot on this site, but it is a Chinese conglomerate similar to BBK that counts Tecno, Itel, and Infinix as its brands. The three brands cumulatively hold a market share of 32% in the region, doubling their growth over the last 12 months. Tecno leads the fray with a 13% share, followed by Itel with 10% and Infinix with 9%.

Huawei had a decent chunk of market share in the Middle East at 8.2%, but that is now at 2.2%. As you can guess by now, Xiaomi, OPPO, and Vivo were the key beneficiaries of Huawei's troubles. Samsung, for its part, has focused on the $100 to $200 segment in the Middle East, and that seems to have paid dividends for the manufacturer. According to IDC's Senior Research Manager Ramazan Yavuz, Samsung's market share in this entry-level segment is over 50% — its highest in any region.

Samsung is now looking to boost its distributor network in the Middle East and incentivize carrier partnerships to boost sales via this channel, says Yavuz.

As for Africa, the region is dominated by Transsion. According to Yavuz, the conglomerate was able to localize the distribution and pricing strategies to meet the local demand, and its initial focus on the African market allowed it to build an early lead. For Samsung to catch up to Transsion, it needs to increase pricing flexibility, launch new product variants to address more segments of the consumer base, and increase visibility in the offline retail sector, notes Yavuz.

Strategy Analytics Analyst Abhilash Kumar also notes that Samsung should focus on a local retail and distribution network to boost sales in Africa. "Tying up with local retailers/distributors to build own hardware and service ecosystem and improve after-sales services will help Samsung."

While Samsung is still in the lead in Middle East and Africa, it is facing increased competition, and it will be a tough undertaking to maintain the top spot.

Can Samsung hold on to its global lead?

While Samsung relied on the flagship Galaxy S and Note series, its momentum in recent years has been on the back of the Galaxy A series. The series was introduced in 2014 and was aimed at the mid-range segment, with Samsung offering features from its flagship Galaxy S series at a more affordable price point. However, the focus shifted three years ago as Samsung folded its entry-level and budget Galaxy J and C offerings into the Galaxy A series, creating a portfolio of devices starting out at $100 and going all the way up to $600.

The shift in strategy and renewed focus on the budget and mid-tier segments has worked out particularly well for Samsung, with models in the Galaxy A series racking up millions of sales in North America and other key markets. I wrote a few months ago that the Galaxy A series is more important to Samsung than its flagship Galaxy S series, and the numbers back that up. The Galaxy A21 was the best-selling Samsung phone globally in Q3 2020, and the Galaxy A10, A10s, A10e, A20, A21, A51, and other budget-focused models have dominated global sales charts while sales of the Galaxy S series plateaued.

Samsung is beset on all sides, but it can weather the challenge from Chinese rivals — for now.

Even though Samsung sought to course-correct with the Galaxy S21 — launching the phone for $200 less than its predecessor — it hasn't been able to make much headway, with the series selling less than its predecessor. With the gains made by the Galaxy A series, Samsung was able to hold on to its crown. That said, the South Korean manufacturer has seen its growth steadily decline over the last four quarters. While some of that is attributable to the pandemic, Xiaomi and Vivo have seen 80% and 50% increases, respectively, during the same window.

That said, it will be a while before brands like Xiaomi can dethrone Samsung globally. "Unlike Huawei – who had a major share in many international regions like Western Europe, MEA and Latin America – Xiaomi is still working on growing its position in those regions," said Popal. "Its growth in Western Europe will be key to sustaining its growth as that's a carrier focused market, a channel that Xiaomi traditionally has not been a key player in. However, the brand is working hard to build relationships with carriers in Western Europe and across other channels, and is focusing heavily to build a strong momentum to grow in that region."

Samsung is still the leading Android maker in terms of revenue, and its global presence and strong carrier partnerships ensure that isn't going to change soon. While Samsung's Chinese rivals built their businesses by focusing on the budget and mid-range segments, they're increasingly turning to the premium category. The latest Android flagships — including the OnePlus 9 Pro, Find X3 Pro, and Xiaomi Mi 11 Ultra — outmatch the Galaxy S21 series in key areas. But these phones are still not available in all global markets, and that puts Samsung at a distinct advantage.

For its part, Samsung is making a clever bet on foldables going mainstream, and the Galaxy Z Fold 3 and Z Flip 3 herald a new direction for the manufacturer. With Huawei's continued woes, Samsung is the only brand that has consumer-ready flagships available for sale, and with this category set to take off in the coming years, it has an early lead that cannot be challenged by its Chinese rivals.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.