With the Dimensity 9000, MediaTek finally has a shot at beating Qualcomm

There's a unified theme across the best Android phones of 2021 — they all feature Qualcomm's Snapdragon 888 platform. Sure, the Galaxy S21 in global markets features Samsung's Exynos 2100, but Qualcomm has an outsized share in the high-end segment.

Qualcomm extended its lead in this segment on the back of robust designs along with marketing efforts — the Snapdragon name has a strong recall in key markets like India and China. While Exynos and Huawei's HiSilicon have tried to make a dent in Qualcomm's dominance, they haven't quite managed to do so in the high-end category.

Then there's MediaTek. The Taiwanese manufacturer relies on the budget and mid-range categories, but it is increasingly turning to the flagship tier. The Dimensity 9000 is its best showing yet, with the platform featuring Arm's latest cores, a new neural engine, and a decent 5G modem.

In fact, the Dimensity 9000 has a lot of similarities to the Snapdragon 8 Gen 1 — Qualcomm's 2022 flagship. Both chipsets use the same core cluster, are built on a 4nm node, and include the latest imaging, multimedia, and connectivity innovations.

MediaTek's initial foray in this category was a disaster

Three years ago, it would have been unthinkable to compare a MediaTek chipset to an equivalent Qualcomm offering, particularly in the high-end segment. MediaTek's first foray in this category was the Helio X30, a ten-core behemoth built on a 10nm node.

The Helio X30 was a shambolic launch for MediaTek.

Released in much fanfare in 2017, the Helio X30 not only failed to measure up to what Qualcomm offered at the time — the Snapdragon 835 — but it also had issues with overheating and efficiency, making it a non-starter. It's no wonder, then, that the Helio X30 faded into ignominy shortly after its debut; other than the Meizu 7 series and the China-exclusive Vernee Apollo 2, MediaTek wasn't able to secure any design wins.

Sravan Kundojjala, director at Strategy Analytics's Handset Component Technology unit, says that the X30 was a setback for MediaTek. "The chip wasn't efficient and had a weak LTE modem that wasn't anywhere close to what Qualcomm was offering at the time. As a result, volumes were low, and the X30 ended up being a failure for MediaTek."

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

Early investment in 5G pays off for MediaTek

MediaTek's turnaround started soon after the X30 debacle. Kundojjala points to MediaTek's decision to abandon its LTE modem efforts — where it wasn't making much headway against Qualcomm — and instead focus on 5G as being the differentiator. In doing so, MediaTek was able to roll out a slew of 5G-enabled designs aimed at the budget and mid-range segments.

MediaTek was quick to launch 5G-enabled chipsets, and it paid off — it saw a threefold increase in sales in 2021.

"MediaTek didn't have a chipset with a gigabit LTE modem, but their shift to 5G meant they were able to deliver chipsets just as 5G services started to take off in markets like China," says Kundojjala. "2020, in particular, was a landmark year for MediaTek because they showed that they could do something on par with Qualcomm."

And the strategy paid off. According to figures shared by Strategy Analytics, MediaTek sold almost 50 million chipsets in 2020, with 5G-enabled designs making up a bulk of the orders. They weren't hurting on the revenue front either. "MediaTek's 4G-enabled chipsets would be sold for around $10, but with 5G, they were able to charge $30 for their mid-range designs," notes Kundojjala.

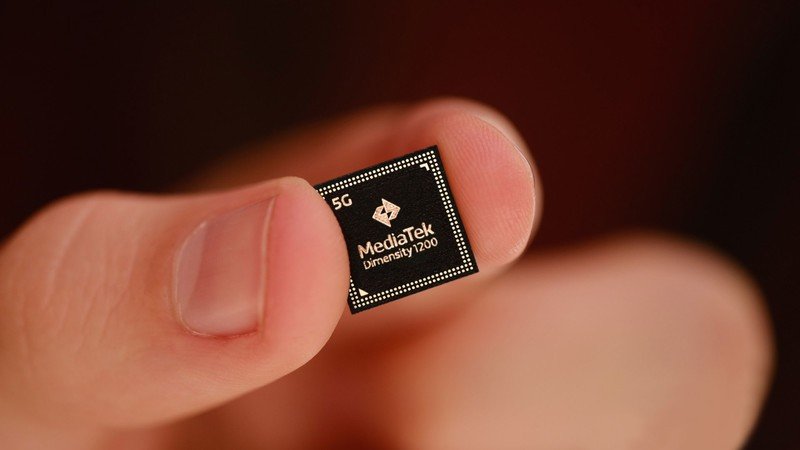

That momentum has carried on in 2021, with MediaTek posting sales of 150 million — three times more than last year. A lot of that has to do with the fact that the manufacturer was able to secure key design wins in the mid-range segment: the OnePlus Nord 2, Realme GT Neo, Redmi K40 Gaming, Xiaomi 11T, and Vivo X70 Pro all featured the Dimensity 1200.

Dimensity 9000 is the first wave in MediaTek's flagship ambitions

MediaTek's mid-range sales resurgence acted as a catalyst for its flagship ambitions, with the Dimensity 9000 the first realization of those efforts.

MediaTek aims to get a double-digit market share with its flagship designs.

It's understandable why MediaTek is aiming for the high-end segment — there's much more potential for revenue. "While MediaTek is now charging $30 for its mid-range designs, it can get more than double that for its high-end chipsets," says Kundojjala. "China by itself accounts for anywhere between 80 to 90 million high-end phones, and MediaTek is aiming to achieve a double-digit market share in the region."

Huawei's tribulations have also played into MediaTek's hands. Huawei's Mate and P series amount to 40 million in sales, and while that number is steadily declining, the brand still has a decent chunk of the Chinese market.

With Huawei no longer able to turn to its in-house HiSilicon unit to deliver the Kirin designs that go in its phones, it needs an alternative. MediaTek is setting itself up to be just that; it already outfits Huawei with 4G-enabled chipsets for budget and mid-range phones, and it is looking to do the same in the high-end category, posits Kundojjala.

North America is still out of bounds for MediaTek

While the Dimensity 9000 is a bold step forward for MediaTek, the manufacturer isn't going to make inroads into North America anytime soon. Kundojjala points to the lack of mmWave 5G connectivity as a deal-breaker for the Dimensity 9000 in the region.

The Dimensity 9000 lacks mmWave 5G, making it a non-starter in North America.

"MediaTek isn't focusing on mmWave for now, and while that saves a lot of complexity, it will be an issue in the long run," noted Kundojjala. "The fact that they don't have an in-house RF unit means they need to source RF front-end modules from the likes of Broadcom, Qualcomm, or Skyworks."

The lack of RF front-end could prove to be a bigger hurdle for MediaTek in the coming years, because it will need to rely on an external vendor for the requisite hardware. Qualcomm, for its part, has a large RF division and delivers an all-in-one solution with its Snapdragon chipsets. MediaTek needs to start doing the same, and soon.

For the time being, MediaTek is focusing on China, India, and select western markets to fuel its growth. The Dimensity 9000 is a great showcase for the brand, one that has the potential to hold its own against Qualcomm in the high-end segment — provided it secures a few design wins. Thankfully, we don't have to wait too long to hear more on that front.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.