Google Pay vs. Wallet: What are the differences?

Google Wallet is back, but Google isn't ditching Google Pay just yet.

Google is particularly fond of rebranding its services every few years, and nowhere is this more evident than its payment strategy. Google folded the older Google Pay service into GPay — a custom version designed from scratch for India — but it didn't roll out the service globally, instead limiting it to a few markets.

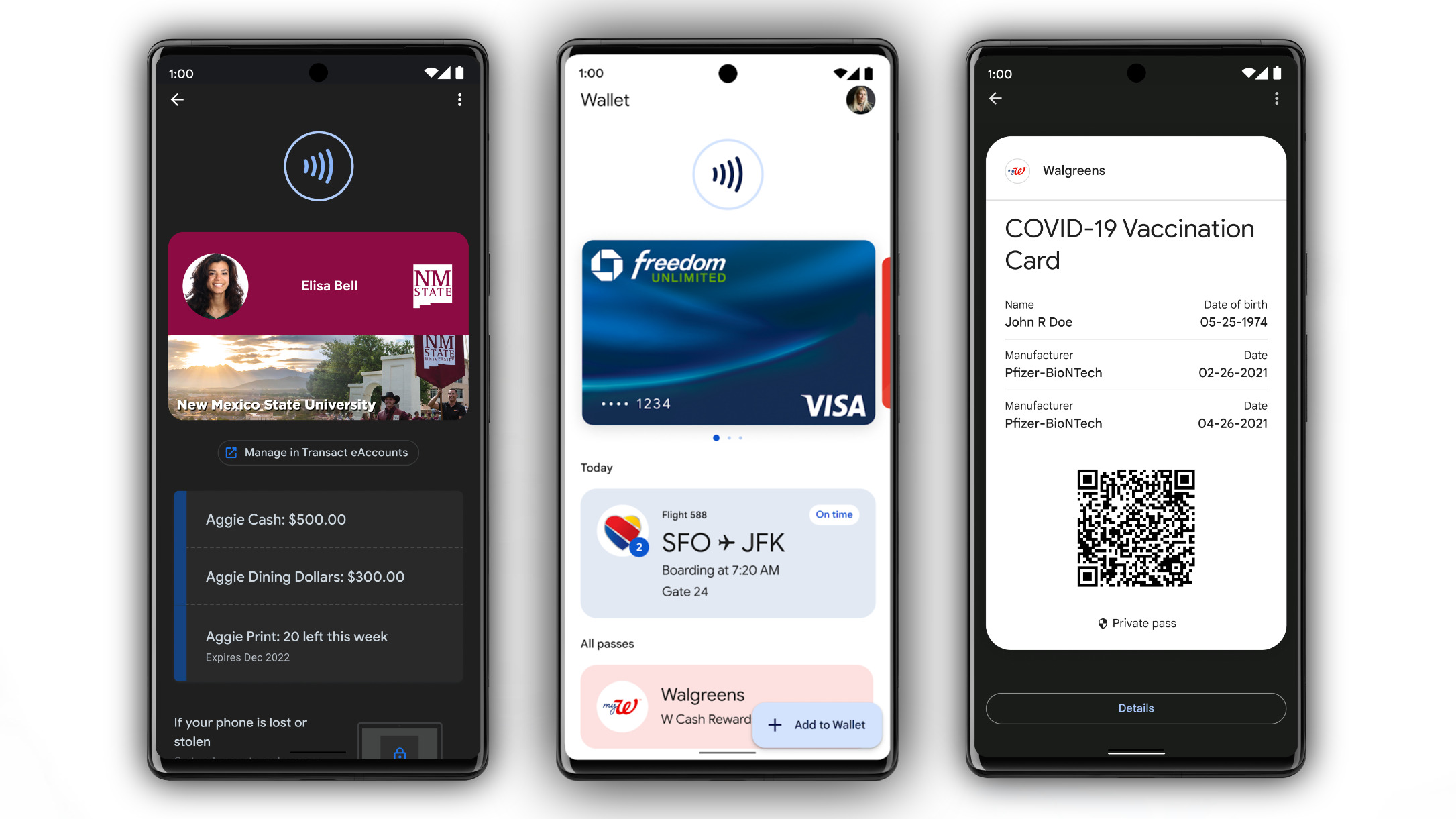

That led to a lot of confusion as there were two distinct versions of Google Pay, and Google is now adding one more product into the mix: Google Wallet. This new iteration of Google Wallet lets you pay using credit and debit cards and works with NFC payments, and you also get the ability to add digital IDs, transit cards, event tickets, car keys, vaccine cards, and so much more.

The new Wallet is Google's latest attempt at a digital wallet that stores all of your cards securely, and it has a lot of potential. However, Google Pay will continue to exist alongside Wallet in select countries, so let's take a look at how we got here, what Google Wallet can deliver, and why you should still care about Google Pay.

Google's payment history: a short primer

Google's first payment service was dubbed Wallet back in 2011, but it was limited to Nexus devices and limited in its feature set. Then Android Pay came along in 2015 to facilitate contactless payments across all Android devices, but Google didn't kill off Wallet just yet; it was instead turned into a peer-to-peer payments service. In 2018, Google folded Android Pay and Google Wallet into a single service called Google Pay.

While all of this was going on in, Google India was working on a brand-new payment platform designed for India. It launched in 2017 and was called Tez, which means fast in Hindi. The service was built to facilitate peer-to-peer payments on India's Unified Payments Interface, and it also picked up the ability to pay utility bills, view transaction history, find local businesses, get rewards, and because this is Google, an easy way to message contacts within the app.

Google is combining Google Pay with Google Wallet.

Confusingly, Google rebranded Tez to Google Pay in India — stylized as GPay — and then rolled out the service in other markets at the end of 2020. Not all countries got this new GPay variant, and that led to two distinct versions of Google Pay — the older version that still goes by Google Pay and is used predominantly around the world, and the GPay variant that debuted in India and made its way to the U.S. and Singapore.

Google is now trying to clear up some of this confusion by overhauling the older Google Pay and merging it into Google Wallet.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

Google Wallet is designed to be so much more

Google Wallet includes all the features that you'll find in Google Pay, including the ability to store credit and debit cards, make contactless payments, get rewards, store loyalty cards, boarding passes, transit cards, and tickets.

You'll also be able to digitize vaccine cards, student IDs, and use Wallet as a digital car key — provided your car offers that feature. Google is working with states in the U.S. and international governments to bring mobile driver's licenses and the ability to store office badges directly within Wallet, and it is working with hotels to enable digital hotel keys.

Google has reaffirmed that Wallet will continue to work on Wear OS the same way Google Pay does currently, and this should come as welcome news to those that were affected with the transition from Google Pay to GPay, which broke tap-to-pay on Android smartwatches.

Essentially, Google Wallet is the evolution of Google Pay, and with the service set to be available in most global markets, it will become the default payments option from Google.

Google Pay isn't going away — at least in these regions

Google Wallet will debut in 38 global markets, where it will automatically replace Google Pay. But the service isn't coming to India, and Google has confirmed that GPay will continue to be the default option for customers in the country looking to make payments. That means Indian users will miss out on digital IDs and all the new features that Google Wallet offers.

But in the U.S. and Singapore, Google Wallet will be available alongside GPay, with Google offering both services. Wallet will be the default option that's pre-installed on the best Android phones going forward, with Google offering GPay as an alternative for making peer-to-peer payments. So if you don't need that particular feature, you can just use Wallet.

Google Wallet is the way forward

While Google could have made the Wallet rollout less confusing, the service itself has a lot of potential.

At its core, Wallet brings together most of the features Google introduced in its payment services over the course of the last decade. And by resurrecting the Wallet branding, Google is making it easier for customers to understand what the service is all about — it's clear that the switch to Google Pay didn't have the desired effect, so this is all about course correction.

We'll have more to share about Google Wallet once it's available, but for now, what you need to know is that Google Pay is going away and Google Wallet is back — at least in most countries.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.