Amazon enjoyed a strong Q4 thanks to record-breaking holiday sales

Amazon attributes its Q4 earnings to the recent Black Friday and Cyber Monday sales.

What you need to know

- Amazon's Q4 earnings hit $170 billion, up 14% YoY, powered by the groundbreaking holiday season.

- Amazon dives into bringing in more revenue from ads with a 26% YoY increase in revenue.

- The company introduced its conversational AI tool called Rufus, helping people shop smarter.

Amazon released its Q4 fiscal year 2023 earnings on Thursday. The company seems to have ended the year on a high note, with $170.0 billion in revenue during the last quarter. This is 14% higher than it reported in 2022 ($149.2 billion).

"This Q4 was a record-breaking Holiday shopping season and closed out a robust 2023 for Amazon," said Andy Jassy, Amazon CEO.

According to the report, customers worldwide purchased over 1 billion items on Amazon and saved nearly 70% more during the 11 days of deals in November compared to the same period in 2022. This included Black Friday and Cyber Monday sales.

"While we made meaningful revenue, operating income, and free cash flow progress, what we're most pleased with is the continued invention and customer experience improvements across our businesses," added Jassy.

AWS segment sales increased 13% year-over-year to $24.2 billion

"A lot of that mix of investment in 2023 was tied to infrastructure, mostly supporting AWS, but also supporting our core businesses was about 60% of our spend. So it reached a very high percentage."

In 2023, Amazon announced massive layoffs across several teams, removing more than 18,000 roles. This was followed by cuts to the Alexa division later in the year after the company launched several products during the Devices & Services event.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

However, while Amazon also announced hundreds of job cuts in January this year, impacting both the MGM and Prime Video departments, Amazon CFO Brian Olsavsky notes that he doesn't see 2024 as a "year of efficiency type thing," according to CNBC.

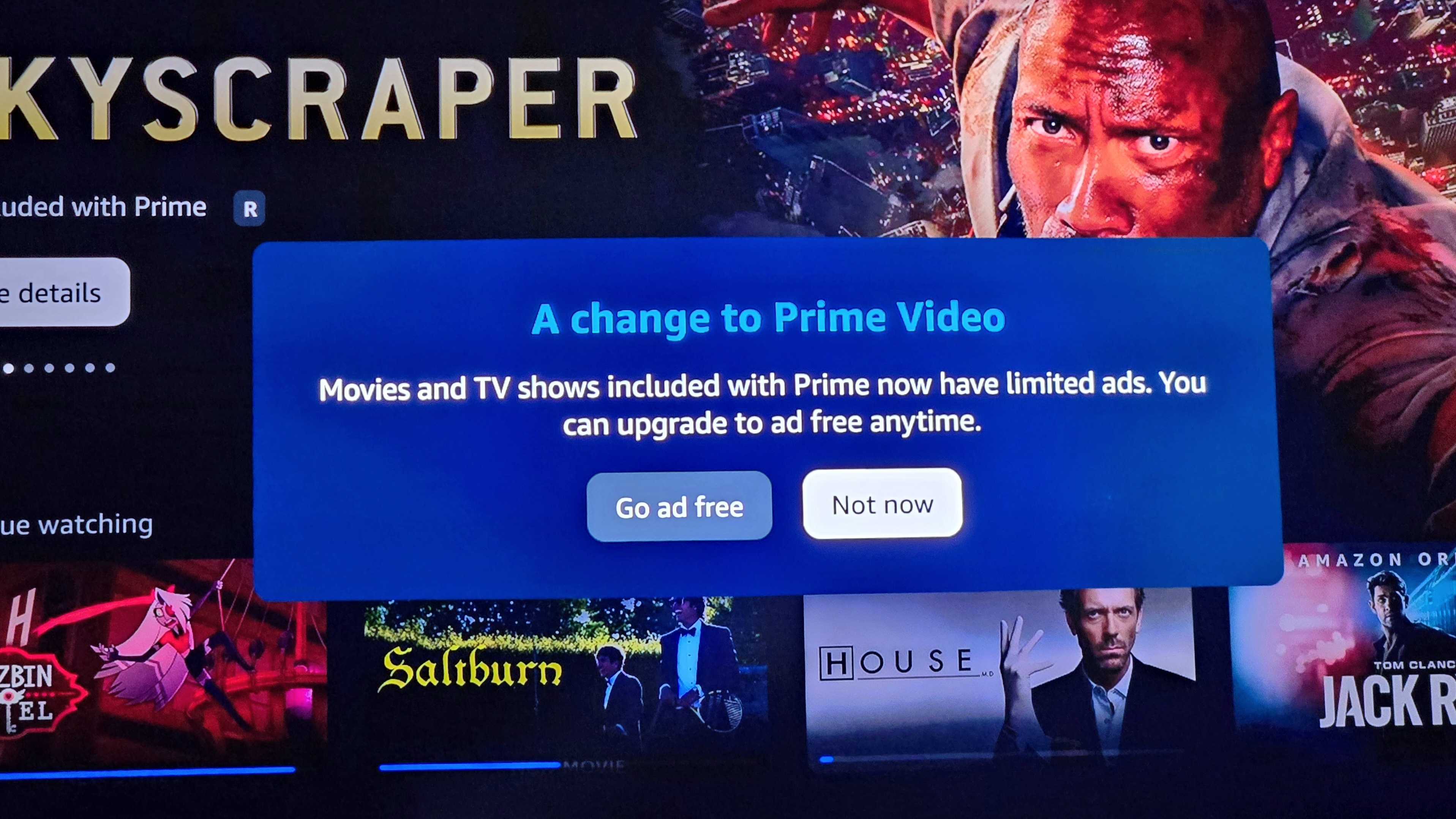

Meanwhile, Amazon's advertising growth "remained strong" and is up 26% year over year, which is primarily driven by our sponsored ads. "And with the addition of ads and Prime Video, we'll be able to continue investing meaningfully in content over time," Jassy added.

Amazon recently rolled out Prime Video with Ads on January 29, requiring an additional $2.99 payment for those opting out.

Amazon also recently got onto the AI bandwagon by releasing its AI generative shopping tool, Rufus. This conversational tool helps pull up shopping catalogs based on the customer's vocal prompts.

"As we enter 2024, our teams are delivering at a rapid clip, and we have a lot in front of us to be excited about," Jassy concluded on the earnings call.

Nandika Ravi is an Editor for Android Central. Based in Toronto, after rocking the news scene as a Multimedia Reporter and Editor at Rogers Sports and Media, she now brings her expertise into the Tech ecosystem. When not breaking tech news, you can catch her sipping coffee at cozy cafes, exploring new trails with her boxer dog, or leveling up in the gaming universe.